Leading figures in Dundee’s digital games industry reacted with delight after the Chancellor unexpectedly announced new tax reliefs for the sector.

The new corporation tax measures will come into force for the video games, animation and television industries next April as part of the government’s ambition to make the UK the ”technology hub of Europe.”

The measure was first raised by Labour in 2010 but was later dropped by Mr Osborne’s incoming coalition government, despite tax breaks being extended to the film sector.

The industry has since warned that UK developers were at a competitive disadvantage to rivals in locations such as Canada, the USA, France and Ireland, where reliefs are available.

Colin Anderson, managing director at mobile games firm Denki in Dundee, said the measure will give a serious boost to the cluster of developers based in the city.

He said: ”Games tax relief will stimulate much-needed investment and innovation in one of the UK’s leading knowledge-based industries. The leadership (industry association body) TIGA has demonstrated throughout this debate has played a decisive role in getting games tax relief on the political agenda.”

Paul Durrant, director of business development at Dundee’s Abertay University a world leader in training computer games developers said the new measure is a ”breakthrough” for the industry.

”By explicitly stating that our computer games industry has the same status as the animation, film and TV sectors, the UK Government has shown it is serious about making Britain an international leader in games production once again,” he said.

”What the UK economy needs is a better environment for early stage, start-up businesses, and the proper support for companies to then grow and expand. The tax relief measure offers a more stable business environment for later-stage growth companies to thrive and stay in Britain, boosting the nation’s creative and economic output.See Thursday’s Courier for extensive Budget coverage and analysis of how it will affect you”Combined with projects like the Abertay University Prototype Fund, which helps launch new start-ups through their earliest stages, we are beginning to form a structure to unlock the incredible trapped value in the UK economy.”

Treasury figures show the government will spend £15 million on tax relief for games firms from April 2013 and as much as £35 million the following year. However, those figures could be altered after consultation with senior industry figures.

TIGA chairman Dr Richard Wilson said the new reliefs would provide long-term benefits to the UK economy.

He said: ”Tax relief for the video games sector will increase employment, innovation and investment in the UK video games industry. Our research shows that games tax relief should generate and safeguard 4,661 direct and indirect jobs; £188 million in investment expenditure by studios, increase the games development sector’s contribution to UK GDP by £283 million, generate £172 million in new and protected tax receipts to HM Treasury, and could cost just £96 million over five years.

”Tax breaks for games production will ensure that the UK remains at the forefront of video game development. It will also help to rebalance the UK economy away from an over-reliance on financial services towards a high skill, R&D intensive and export focused industry.”

Dundee City West MSP Joe FitzPatrick, convener of the cross-party group on computer games at the Scottish Parliament, said it is a major step forward for the digital creative industries.

He said: ”The measure will deliver a vital spur for games developers and will generate a good return on the investment to as the UK game development sector takes advantage of projected growth worldwide. This will sustain existing jobs and undoubtedly lead to the creation of more as the sector in Scotland expands and develops.”

Labour’s Dundee West MP Jim McGovern said: ”This is a welcome U-turn, but why on earth did George Osborne scrap the tax credits in his first Budget? It is utterly bizarre. It jeopardised Dundee’s world-leading position and the intervening period is lost time for the Scottish video games industry.

”This is now a start to the future partnership between the industry and the government to ensure the UK computer games sector becomes a world leader, and Dundee will stand to benefit enormously from that.”

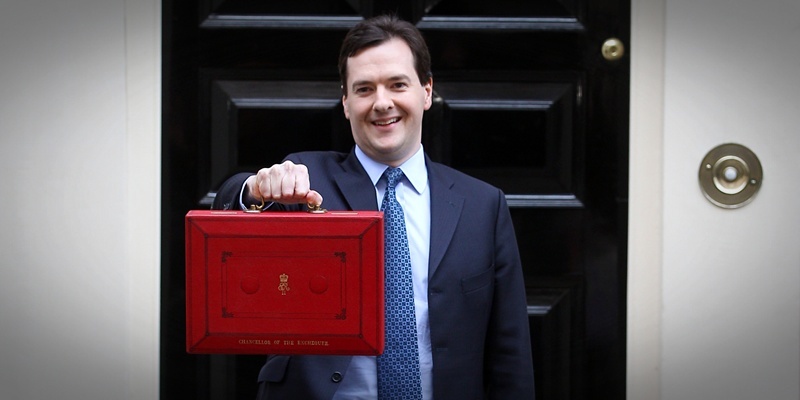

Photo by Lewis Whyld/PA Wire