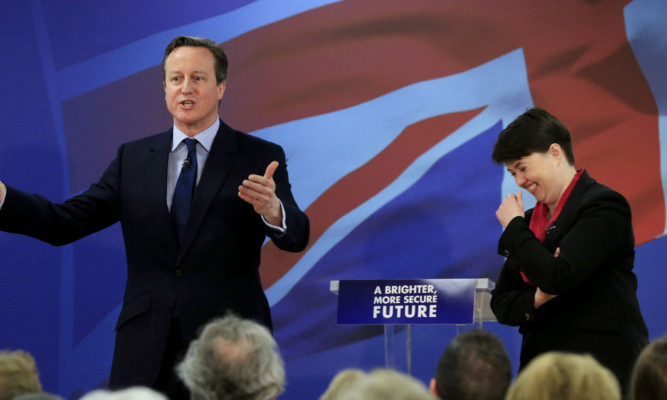

The leader of the Scottish Conservatives has said she is “more than happy” to publish her tax returns in the wake of the Panama Papers leak.

Ruth Davidson made the statement as Jeremy Corbyn called on government ministers, including Prime Minister David Cameron, to make the data public and said he would be happy to do so himself.

UK Tory leader Mr Cameron declared he has “no shares, no offshore trusts, no offshore funds”, after his late father Ian’s tax affairs were highlighted in the document disclosure.

“I’m more than happy to publish that (tax return data),” Ms Davidson told The Courier.

“I don’t have any income outside of what I earn as an MSP.”

The Prime Minister himself has sought to distance himself from the data leak row, with Downing Street insisting his family “do not benefit from any offshore funds”.

Labour leader Jeremy Corbyn dismissed suggestions by Downing Street that the family’s tax arrangements were a “private” matter and called for an independent investigation into those implicated by the records.

But Mr Cameron sidestepped calls for a probe and declined to say if his family had reaped the rewards of an offshore arrangement in the past or were likely to in the future.

The Prime Minister was asked to confirm that “you and your family have not derived any benefit in the past and will not in the future” from the offshore fund set up by Ian Cameron referred to in the papers leaked from Panama law firm Mossack Fonseca.

During a visit to Birmingham, Mr Cameron said: “In terms of my own financial affairs, I own no shares. I have a salary as Prime Minister and I have some savings, which I get some interest from, and I have a house, which we used to live in, which we now let out while we are living in Downing Street, and that’s all I have.

“I own no shares, no offshore trusts, no offshore funds, nothing like that. And so that, I think, is a very clear description.”

He insisted that “no prime minister has done more” to crack down on tax evasion and aggressive tax avoidance.

And Ms Davidson defended the UK Government’s record on cracking down on tax dodging, despite Mr Cameron’s father being named in the tranche of documents.

“It’s worth pointing out that some of the stuff in this particular example goes back decades,” she said.

“These are things which have been in train for a long, long time and it is exactly this government that is trying to stop stuff happening and I believe they deserve our support.”

The focus on Mr Cameron’s personal finances came as Iceland’s prime minister became the first political casualty of the Panama Papers leak.

Sigmundur David Gunnlaugsson quit in the face of mass protests over reported offshore financial dealings by him and his wife.

Mr Cameron’s father ran an offshore fund that avoided ever having to pay tax in Britain by hiring a small army of Bahamas residents – including a part-time bishop – to sign its paperwork, according to the Guardian.

Ian Cameron, who died in 2010, was a director of Blairmore Holdings Inc, which, until 2006, used unregistered “bearer shares” to protect its clients’ privacy.

His use of the firm to help shield investments from UK tax helped build up a significant legacy, part of which was inherited by the Prime Minister.

There is no suggestion that this avoidance arrangement or others exposed by the leak were anything but entirely legal or that Mr Cameron’s family did not pay the UK tax due on any repatriated assets.

Mr Corbyn said he wanted an investigation conducted by HM Revenue and Customs “about the amount of money of all people that have invested in these shell companies or put money into tax havens and to calculate what tax they should have paid over the years”.

The Labour leader said: “It’s a private matter in so far as it’s a privately held interest, but it’s not a private matter if tax has not been paid.

“So an investigation must take place, an independent investigation.”

Mr Corbyn also suggested the Government could intervene to take direct control of the UK’s offshore tax havens.

“If it’s necessary for ministers to intervene because the governments of the Overseas Territories won’t act, they can use an order in council to take control of them immediately,” he said.

The Prime Minister has championed the transparency agenda at a series of international summits, and legislation forcing British companies to disclose who owns and benefits from their activities comes into force in June.

But despite several years of pressure, the Crown Dependencies and Overseas Territories have proved reluctant to fully open up their business registers to UK law enforcement agencies.

Mr Cameron hopes for more action ahead of a major international anti-corruption summit he is hosting in May.

A Number 10 source said the Crown Dependencies and Overseas Territories must deliver “full and effective transparency” for the UK authorities on the beneficial ownership of companies in their jurisdictions.

The UK believes it is close to agreement with the Crown Dependencies, Bermuda and Gibraltar but “we need to get Cayman Islands and British Virgin Islands over the line” by the May summit.