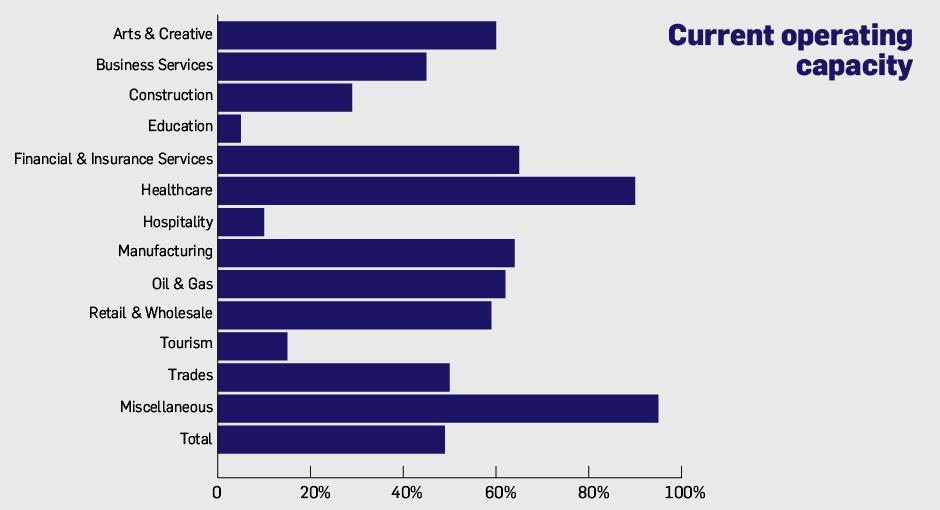

Businesses in Dundee and Angus are currently operating on average at less than half their capacity.

An in-depth survey of the business landscape by Dundee and Angus Chamber of Commerce has shown a slump in activity.

The latest quarterly economic survey shows on average companies are working at 49% of capacity. This compares to a reading of 71% in the last three months of 2020.

What’s behind the decline in activity?

In most sectors the current lockdown restrictions are the main reason for the decline.

Hospitality firms are working at an average of 10% of capacity and tourism firms at 15%.

Businesses classed as education, which includes training and workshop providers, are at just 5% of capacity.

At the other end of the scale, healthcare firms are operating at 90% of capacity, finance at 65% and manufacturing at 64%.

Pressures mount in some sectors

Dr Shona Dobbie, from Angus Economics, who compiled the report, said: “This shows the pressures on businesses in the region.

“The sectors that are doing poorest at the moment are face-to-face service type sectors.

“Hospitality is at 10% – it had risen to 35% in the third quarter of last year. That’s disappointing but understandable to see that’s way down during lockdown.

“The results make sense given the restrictions we are working under.

“We would want to see operating capacity much higher when we look at the results in the second quarter.”

The economist said the 90% capacity for healthcare was much higher than the first lockdown.

She said this showed businesses like dentists, physiotherapists, chiropodists, had found a way of being able to see more clients.

The relatively high manufacturing figure showed “the resilience in this sector,” Ms Dobbie added.

She said there were signs of structural decline in oil and gas markets that were not linked to restriction.

Some positive signs in survey

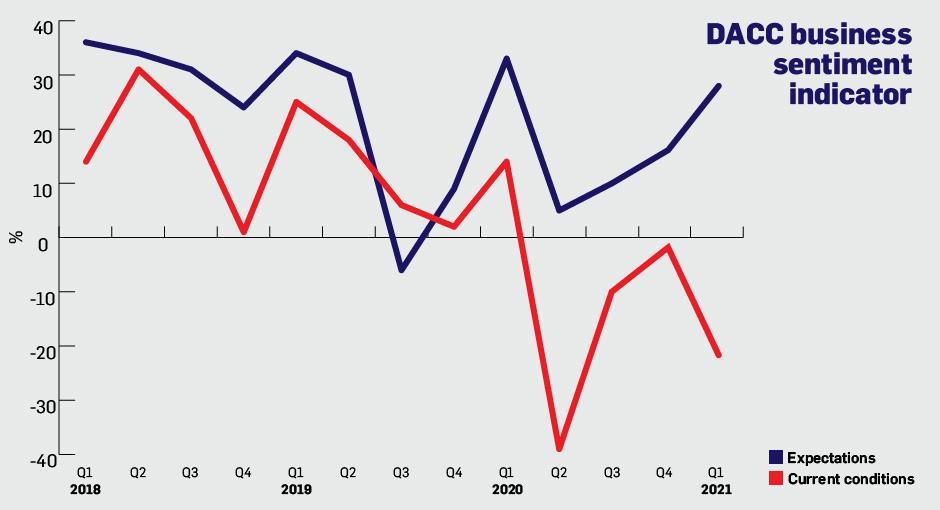

The survey’s overall business sentiment indicator showed a net balance of -22% compared to -2% in December’s survey.

But despite the current tough trading conditions there were also positive signs in the in-depth survey.

Optimism among firms in Dundee and Angus is at its highest level since the pandemic hit.

“Every sector is telling us that they expect prospects to improve in the next 12 months,” Ms Dobbie said.

“I do have to caveat that with the fact 8% of firms are concerned they may not be able to survive. Different sectors are having different experiences and some are still struggling.

“But overall companies are much more optimistic looking forward.

“The sectors that are most optimistic are arts and creative, construction, tourism and trades.

“While current conditions are tough, expectations are positive. This encourages companies to invest and households to spend.

“The vaccine rollout is giving optimism to the future and the reading is the highest since the pandemic began. There are signs of hope.”

Other findings from the survey

- Revenues, orders, profits and cashflow all showed overall decline in the first quarter of 2021. Wages

- Only 23% of local businesses reported total orders increased while 36% said they had fallen.

- Employment weakened in the first quarter but overall firms expected to take on more workers this year.

- 85% of local businesses expect sales revenue to increase or remain constant over the next three months.

- Covid-19 has forced 32% of survey respondents to make changes to their products or services