Optimism among firms in Dundee and Angus has risen above pre-Covid levels according to a new survey.

There are positive signs of recovery in the latest Dundee and Angus Chamber of Commerce quarterly economic indicator, which surveys its hundreds of members.

The majority of firms expect their business prospects will improve in the next few months.

However, the survey outlines stark differences between sectors.

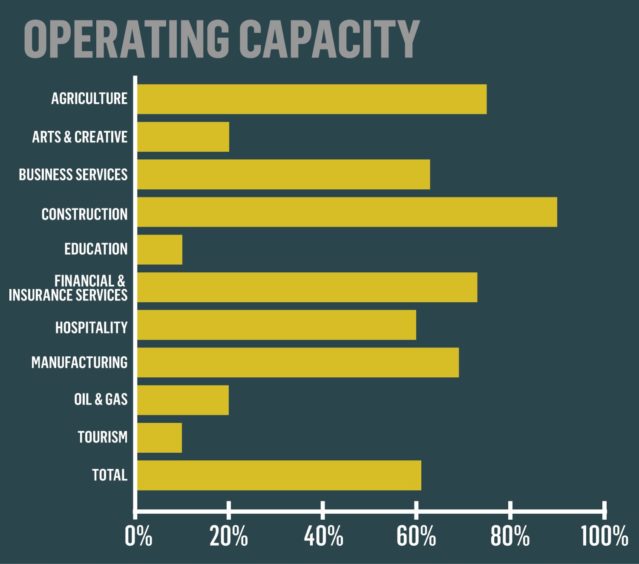

An analysis of operating capacity shows that tourism and education firms were operating at just 10% of their potential.

Businesses classed as arts and creative and oil and gas were operating at just 20%.

Meanwhile construction companies were at 90% capacity, agriculture at 80% and manufacturing and financial services close behind.

Overall, operating capacity increased to 61% compared to 49% in the last quarterly survey.

However, a majority (54%) of respondents are still operating below capacity.

Dr Shona Dobbie, from Angus Economics, who compiled the report, said: “This gives cause for concern.”

Key indicators turn positive

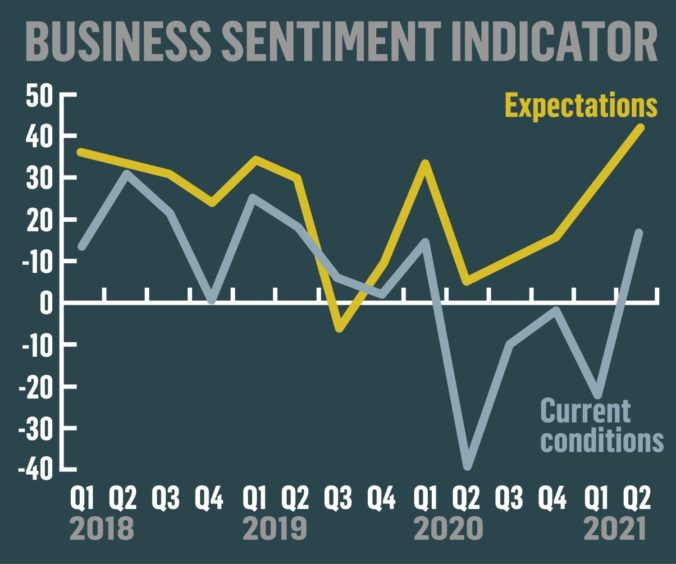

The key indicators from the survey were all in positive territory for the first time since the first quarter of 2020.

These cover revenue, online sales, orders, profits, cashflow, investment, wages and employment.

While there was a jump in the volume of orders, profits and cashflow remain low, confirming business conditions remain challenging.

Ms Dobbie said: “It is encouraging to be able to report a sharp improvement in every key variable we assess.

“The scale of improvement provides a welcome degree of confidence about a brighter future for local businesses as we gradually return to some form of normality.”

‘Cautious optimism’ at results

Dundee and Angus Chamber of Commerce chief executive Alison Henderson said “cautious optimism” was the theme of the results.

She said the results showed local firms were finding opportunities “in the hardest of time” which was a credit to the resilience of leaders.

“The impacts of the pandemic on trading conditions in 2021, combined with the uncertainty of Brexit implications have left many business leaders hoping for the best, planning for the worst and delighted when the actual trading outcome falls somewhere in between,” she said.

“Business leaders are putting their people at the heart of designing the future of our businesses.

“Two-thirds of respondents already adopting flexible working to support operational demands and safety of those in our workforces.

“Change is still happening at an accelerated pace, with not only adaptations to the physical spaces, but the products and services that we deliver.

“Unfortunately, that is also accompanied by one third of businesses reducing working hours.

“As businesses ramp up their operations, we are finding that there is a shortage of people to fill vacancies.

“As the furlough scheme begins to change, this imbalance of demand to supply of people may adjust itself and we will keep a careful watch on how this impacts business.”

Other key results from the survey of Dundee and Angus firms:

- 91% of firms said revenues raised in Scotland had increased or remained consistent in the last three months

- Oil and gas was the only sector to report less staff this quarter

- Tourism and oil and gas are the only sectors to have negative employment expectations

- 96% of Dundee and Angus firms expect sales to be constant or increase next quarter