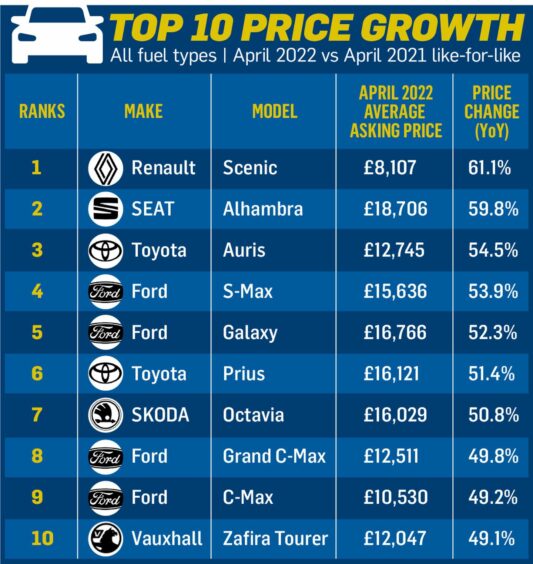

The price of a used car has increased by up to 60% in the past year amid a surge in demand and delays in production.

New data from Auto Trader showed the average price of a used car increased 32.2% on a year-on-year in April.

The price of used cars has been on the rise since the beginning of the Covid-19 pandemic.

The latest data marks the 25th consecutive month of price growth.

However, while prices are on the rise, the data does point to a slowing of the market.

Why are used car prices so high?

Dealerships across Tayside and Fife experienced a surge in demand for cars at the end of the first Covid-19 lockdown in summer 2020.

Richard Lawson, who runs Tayside dealership Auto Eccose, explained the situation.

He said: “It was a perfect storm in the industry a year ago.

“We had the reactivation of the economy post-Covid. The shortage of new cars stimulated the interest in used cars.

“That was equally influenced by people not being confident in public transport and that perhaps still prevails.

“At that point, prices significantly increased.”

In 2020, many people decided to invest the money they may otherwise have spent on a holiday on buying a new car.

However that coincided with a global shortage of electronic components, leaving car manufacturers struggling to meet demand.

That meant demand in used cars rose sharply, and so did prices.

Now, the war in Ukraine could also have an impact. A drop in the supply of steel potentially creates further problems for car manufacturers.

When will prices return to pre-Covid levels?

While the figures suggest the market is slowing, used car prices are not expected to return to pre-pandemic levels any time soon.

The slight slowing is the result of a number of factors, not least the fact that growth is now overlapping last year’s levels of 7.1%.

Further contributing factors include a softening in consumer demand, fuelled by the rising cost of living and concerns around the economy.

Another factor is the prospect of a significant reduction in disposable incomes.

Mr Lawson added: “Since the beginning of 2022, there has been a gradual downturn in wholesale prices and that has led to a softening of the retail price as well.

“The industry is so sophisticated – it’s just like the Stock Exchange.

“The market can be impacted by a number of consumer concerns.

“There’s a lot of trends you have to watch to see what could impact the marketplace and affect demand.”

No suggestion prices will tumble soon

Auto Trader’s director of data and insights Richard Walker said the latest figures do not mean the used car market is in reverse.

Mr Walker said: “In such a fast-moving market, it’s easy to lose sight of just how exceptional 2021 was for the industry.

“Context is critical and any suggestion that the used car market is in reverse or prices are set to tumble, is at best an oversimplification, and at worst a misinterpretation of the data.”

He said limitations on stock have impacted sales compared to pre-pandemic levels, but said consumer demand and prices remain “robust”.

Mr Walker added: “Our data highlights many segments of the market are performing at varying degrees.

“It’s vital therefore that during this period of turbulence, retailers look beyond a national average view.

“They must also adopt a strategy that is led by data to identify and focus on areas they can win.”

Conversation