Hundreds of curries. Tens of thousands of pounds. Transcontinental bank transactions, cross-country identity theft, spurned sting opportunities and organised criminals still at large.

Crieff restauranteur Karna Khadka, like many, was left financially punch drunk by Covid-19, but thought he’d found a new customer and the light at the end of his tunnel.

Nine months and more than £40,000 later, The Gurkha’s restaurant remains hamstrung after scammers running an international racket raided them for hundreds of curries and alcohol with fraudulent Asian bank details.

In this investigation we reveal how the scam worked, track down a family ensnared in a web of illicit transactions and attempt to unmask the mysterious kingpin, Mr Brown.

October 29, 2020

Across October and November 2020, faceless grifters placed £44,000 worth of orders at The Gurkha’s restaurant and takeaway for a trio of phoney functions.

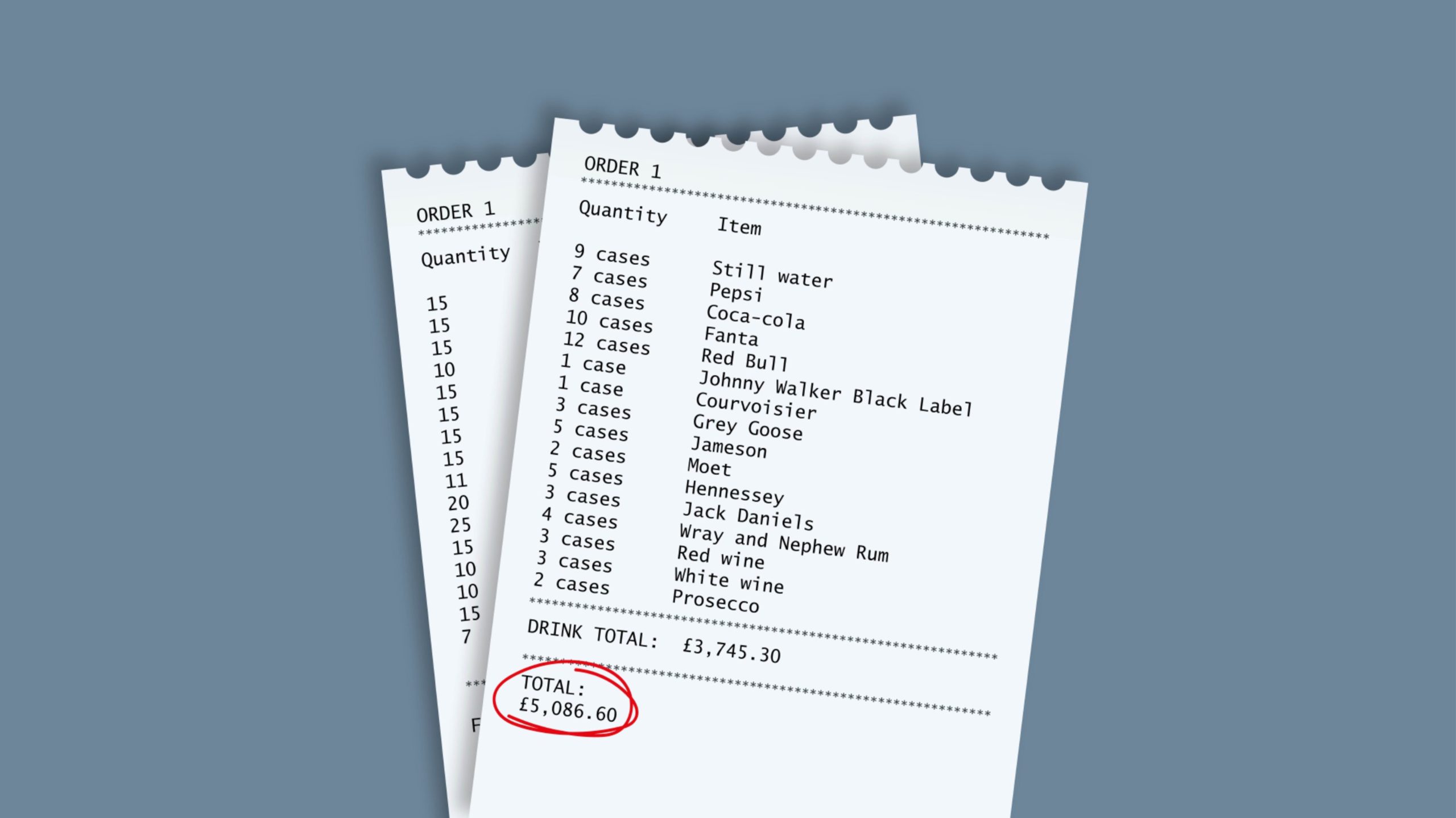

The first order was received by The Ghurka’s in late October and was worth a fraction over £5,000. Staff had three days to prepare it and a four-figure deposit was accepted by management.

Having received the sizeable deposit, Karna quickly bought in enough stock to meet the mammoth order placed by “Adam Brown.”

When ready, the food and drink order was handed over to drivers who came to the restaurant to collect it after Karna had received full payment.

Paid over the phone, the payment went through first time and Karna received a Whatsapp message shortly after from his cruel customer praising his team’s cooking.

November 1, 2020

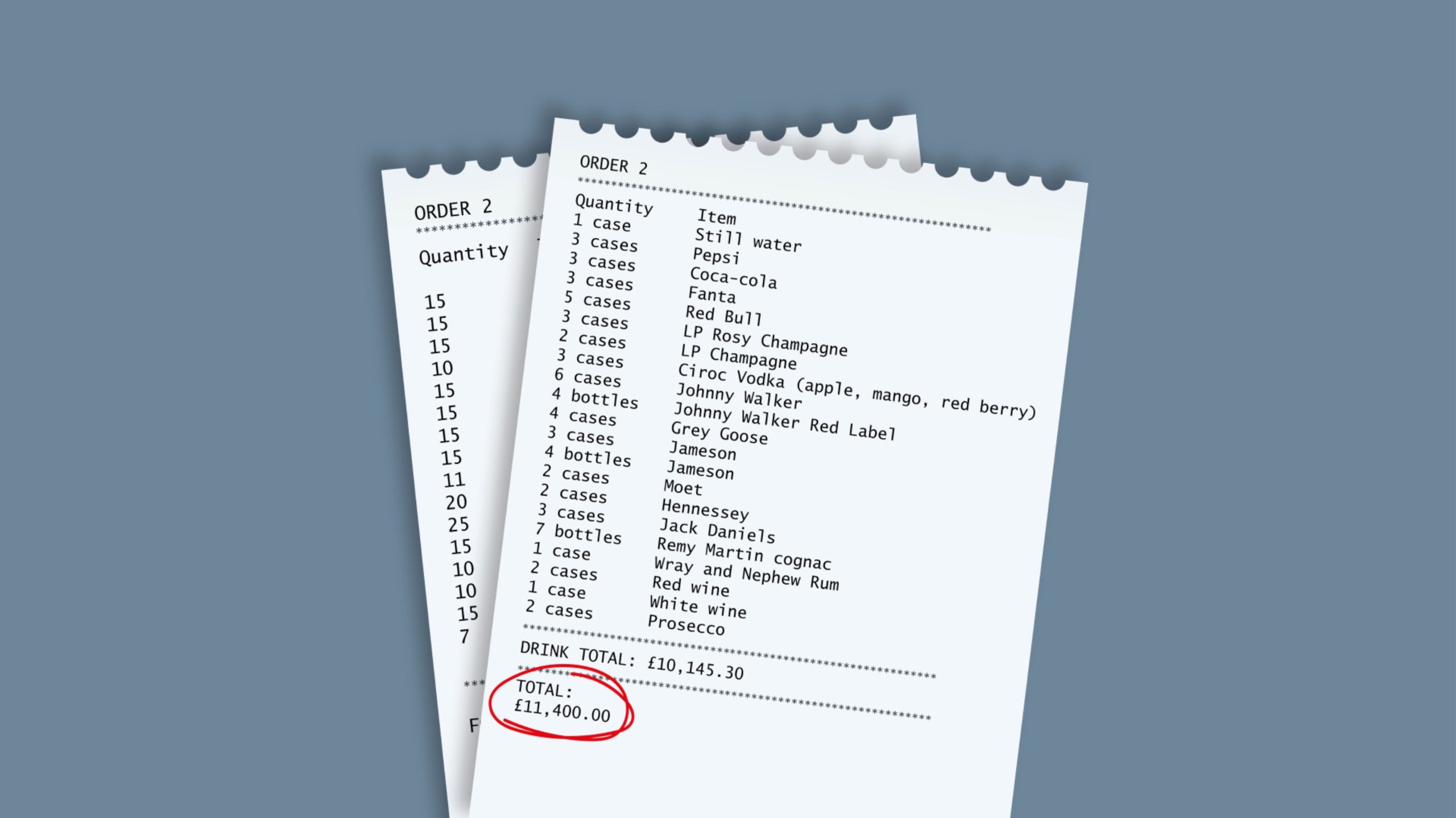

Used to preparing four figure orders for functions, Karna took another deposit from the same customer days later worth £11,000.

Mr Brown increased his order to food for 80 people and ramped up the booze demands.

Again, a deposit was paid and the money payment went through for what Karna was told was another function.

November 5, 2020

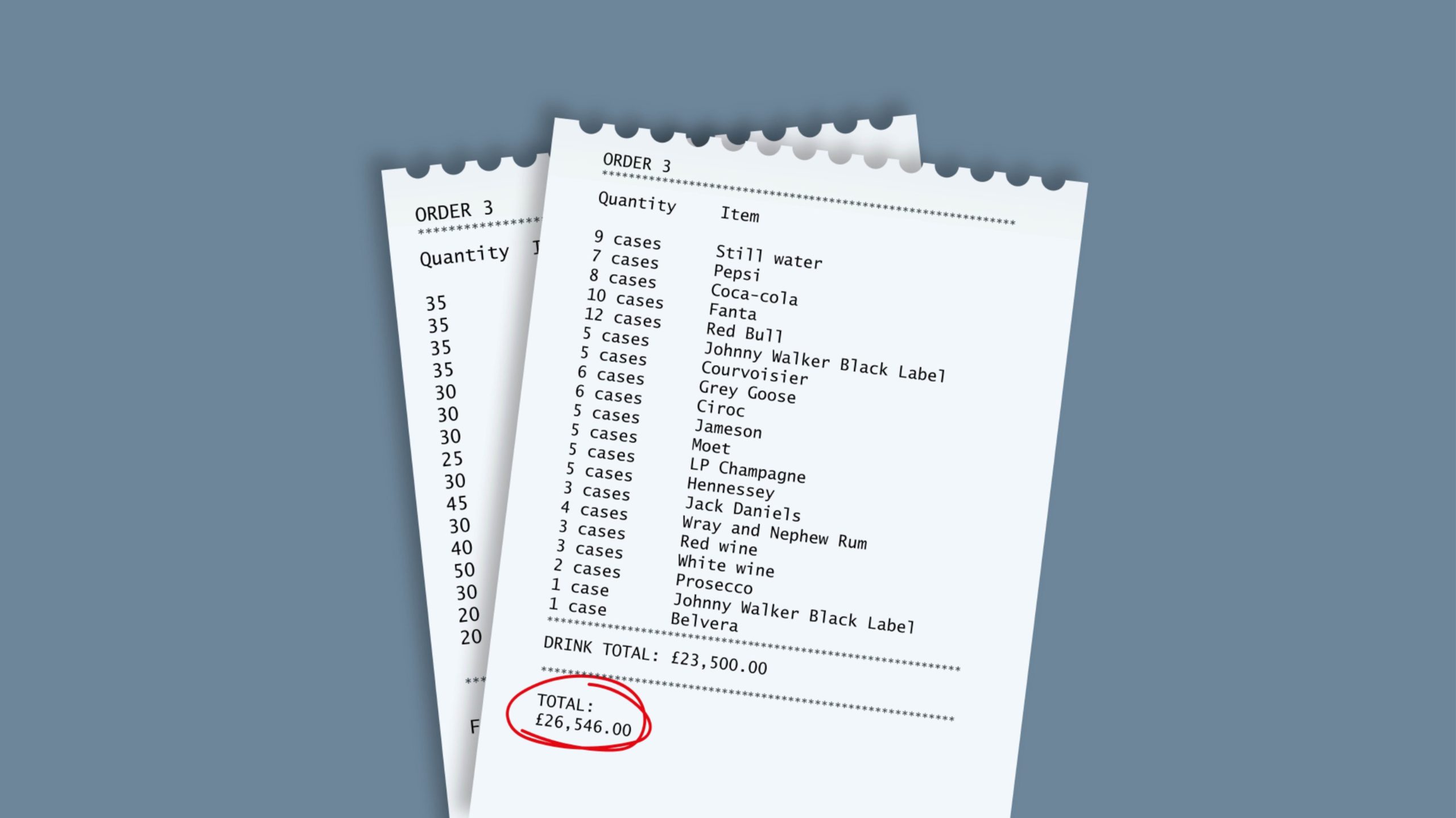

With their relationship seemingly flourishing, the brazen crooks placed one last gigantic order worth almost £27,000 a few days after.

This final order was so substantial that Karna had to close his restaurant for a week to focus on cooking everything requested, and meant that his local cash and carry ran dry and he had to complete the alcohol shop in Glasgow and order meat in from English suppliers.

Karna coughed up more than £30,000 altogether on stock to meet the demands but was looking to cash in after a tough year as a lockdown-hit business.

Once again, a deposit worth thousands of pounds was accepted and Karna got to work making hundreds of curries. The payment, made in nine £3,000 instalments, was accepted over the phone.

But disaster struck a week after when Karna’s bank, Santander, phoned to deliver some bad news.

Karna was told by Santander the payments were made using a fraudulent credit card and the money from all three orders was removed from his account.

The bank explained that the card, which was registered to an account in Hong Kong, was being used illegally.

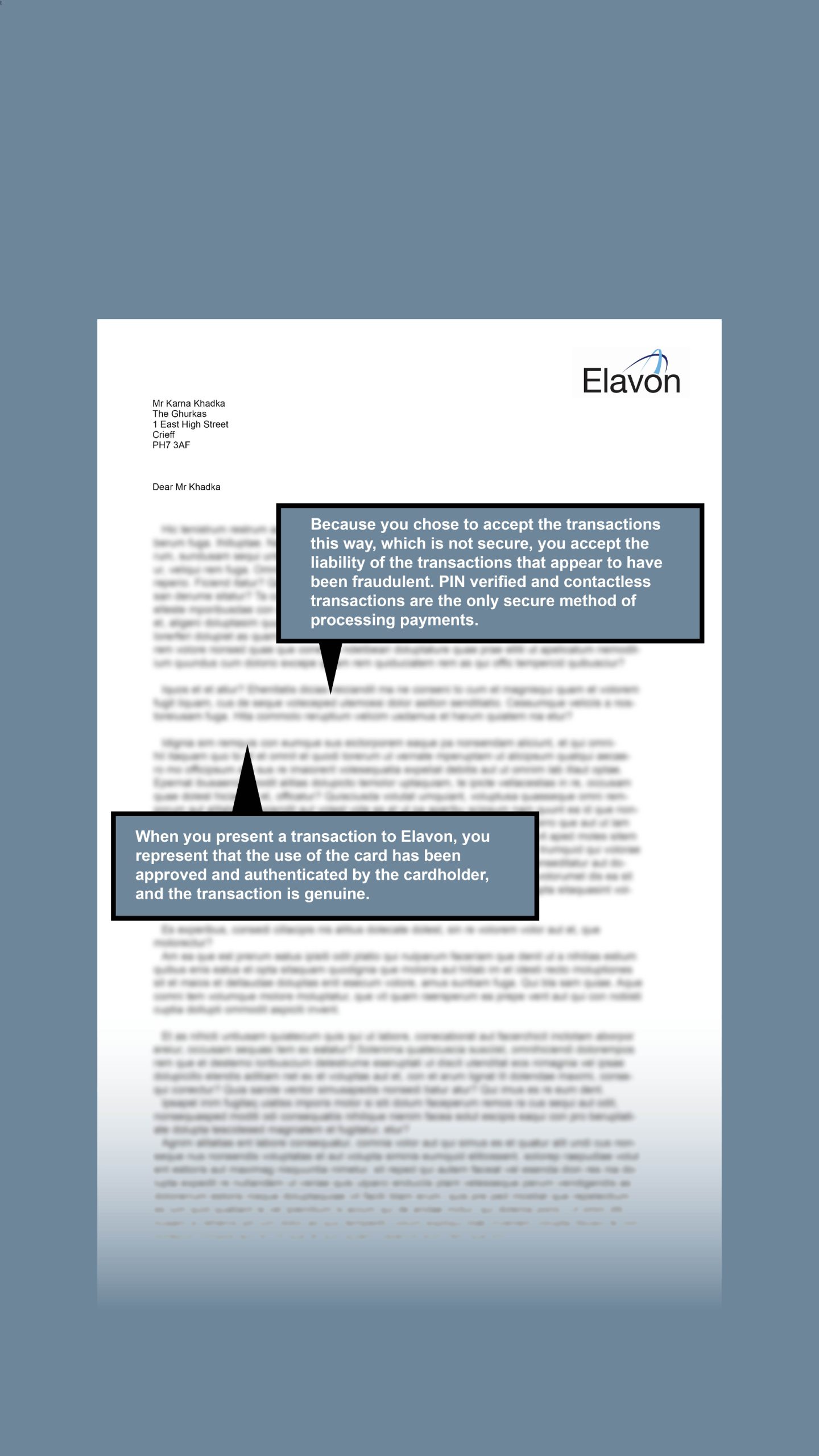

Their fraud squad had been contacted by Elavon, the company Mr Khadka’s business uses to process card payments.

Elavon notified the bank that, in total, £43,100 of the payments made to the business current account were potentially fraudulent.

Eight days later, they requested that Santander return the funds and provided the bank with an indemnity. Santander duly obliged.

‘Utmost sympathy’

In a letter sent to Karna at the beginning of the year, the bank say they “can understand his frustration.”

A Santander spokesperson said: “We have the utmost sympathy for Mr Khadka, and all who fall victim to the criminals who carry out fraud.

“In this situation, we returned payments to the bank they came from after we were contacted by Elavon, the company which processes card payments for Mr Khadka’s business, informing us they were fraudulent.

“We have advised Mr Khadka to pursue the matter with Elavon.”

Santander stress they have no involvement with the security checks Elavon completes prior to Karna’s account receiving the payments.

To rub salt into the restauranteur’s wounds, Elavon are still chasing him for thousands of pounds in transaction fees needed to convert almost half a million Hong Kong Dollars into sterling.

Furthermore, some of his more sizeable card transactions from regular locals are being blocked and Karna feels he may have been blacklisted somewhere along the line.

A spokesperson for Elavon said: “We are very sympathetic towards Mr Khadka.

“However, we are unable to comment further however on the details of his case in the interests of privacy.

“Elavon takes fraud and data security seriously, and has robust systems and processes in place to prevent and report fraud incidents.

“Fraud prevention starts when we bring new customers on-board, and extends to transactional data security, fraud prevention technology and customer education on what’s required to take payments safely, securely and efficiently to stop financial fraud before it happens.”

Concerned Karna quickly contacted the police.

In a letter they sent to Karna, the company claim that as the customer was not present when the transaction was completed, the business becomes liable.

It read: “Our records show the transactions were processed as keyed Customer Not Present (CNP).

“Because you chose to accept the transactions this way, which is not secure, you accept liability of the transactions that appear to have been fraudulent.”

Karna said he is no longer using Elavon.

Karna’s neighbours on Crieff’s East High Street captured the white Citroën Relay van which collected all three of the con artists’ orders on external CCTV, however security footage has now lapsed.

The Nepalese restaurant’s boss did, however, make a note of the fraudster’s vehicle registration plate.

Karna also has a phone number and email address for the “Adam Brown” who placed the orders and has an address for him in Gullane, East Lothian.

However, the phone number is now no longer connecting and after making the three- hour round trip to the address he was given, Karna found the property empty and presumed it to be a front for organised crime.

The Courier also travelled to Gullane to investigate the address given to him, only to make a startling discovery.

Living at the residential property in a quiet corner of the East Lothian village were Mhairi and Mark McCran, a couple who have spent much of their lives living under the shadow of identity theft.

Mhairi, who didn’t wish to appear on camera, explained that she’s had police officers and disgruntled businesspeople on her doorstep in the past, enquiring into frauds and chasing up missing cash.

“Every time you start to relax and think that’s it over, something else happens,” she said. “This is our life.

“Last time, it was the owner of a garage who came here. He wasn’t from far away.

“Whoever is using this address had got a substantial amount of work done on a car and then the money disappeared.

“The police have been here a few times. I’ve spoken to them over the phone and it’s been officers from down in England.”

Mhairi had been the embroiled in another identity theft hell when she stayed at a previous address in nearby Tranent (Carlavrock Grove).

‘He definitely has to be stopped’

She and her family emigrated to Australia but came back to find the issue showing its ugly face again when she returned to Scotland.

Having moved to Gullane almost a decade ago, her life has recently been sucked back into a “nightmare” and still feeling the repercussions, wants to see unscrupulous shyster “Mr Brown” brought to justice.

The star-crossed couple have had bother trying to book holidays, buy cars and pay for home renovations and suspect the dark clouds of fraud which have been following them for years are to blame.

It’s absolutely mind-boggling that people feel they can do this to other people.”

Mhairi McCran

She’s even had bother getting regular online orders delivered to her home.

She added: “Years and years ago we had the same thing, somebody using our address.

“It is a bit of a nightmare. We’ve been blacklisted.

“We started to get letters about money then phone calls from police.

“We contacted to Post Office to say these are not for us.”

Police Scotland describe the events Mhairi and Mark have experienced as “warning signs” of identity theft on their online advice on the matter.

Mhairi wasn’t aware of the latest scam utilising her address and she hadn’t heard the name Adam Brown before. Her heart goes out to Karna and says she’s yearning for this sorry saga to come to an end.

“He’s obviously good at what he does. He definitely has to be stopped.

“It’s really caused massive problems.

“It’s absolutely mind-boggling that people feel they can do this to other people.”

After receiving notification that almost £44,000 was being removed from his account, Karna was approached a fourth time by brazen Mr Brown.

At this point, he walked around to Crieff Police Station and offered to set up a sting with officers waiting to arrest Mr Brown’s collection drivers.

However, Karna was gutted to see officers decline his snare offer.

Nine months on, the case has gone cold.

We contacted the police as part of this investigation and was told they wouldn’t comment on specifics of an enquiry while it is ongoing so were unable to confirm if they had traced the van.

A police spokesperson said: “We received a report of fraudulent activity directed at a business in the East High Street area in Crieff on Friday, 6 November, 2020.

“Inquiries into the incident, which involved the false use of credit cards, are ongoing.”

The spokesperson added: ““We are very aware of the disruptive and damaging effect fraud has on businesses and Police Scotland continues to work closely with a range of partners to make Scotland a hostile environment for scammers.

“Businesses should be vigilant against fraudsters who can claim to represent a supplier or fellow business in order to solicit payment or fraudulently purchase goods or services without then paying for it.

“People should be aware that unsolicited emails, text messages and calls may not be from the person or organisation which they appear to be from. It is also important to be vigilant if dealing with a new supplier or buyer and to ensure who you are dealing with is genuine, particularly if the transaction involves a large amount of money.

“If you receive any communication that you are in anyway concerned about please do not give out any personal details or payment information. “Don’t feel pressured to give out information. A genuine business or trader will understand the need to be cautious. “If you feel you may have been the victim of a fraud then contact your bank immediately and you can report any suspected criminality to Police Scotland by calling 101.”

Karna has also turned to local MP John Nicolson, who has been in dialogue with Santander.

Mr Nicolson did not wish to provide comment at this point as enquiries are ongoing.

We also tried to contact Mr Brown but have had no reply.

Credits

- Words by Ross Gardiner

- Design by Cheryl Livingstone

- Graphics and title image by Clarke Cooper

- Video by Steve MacDougall and Blair Dingwall