Property experts are warning a “tartan tax” is in danger of undermining high-end property sales in Perthshire.

The introduction last year of Land and Buildings Transaction Tax (LBTT) to replace stamp duty is having an “eye watering” impact on the property market, according to a leading land and estate agent.

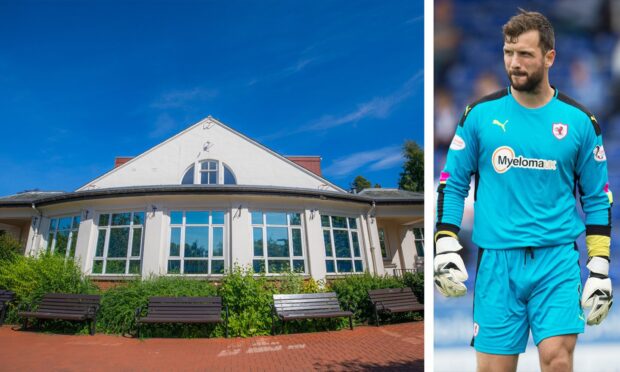

While a Scottish Government committee has hailed the introduction of LBTT in Scotland an “operational success”, Perthshire-based Bell Ingram say the market picture is a complex one.

They report a range of effects including one buyer who had to pay £130,000 in property taxes to acquire a home in the Auchterarder area.

The tax was introduced in Scotland in April last year in place of stamp duty and is designed to make the charge more proportionate to the price of the property.

Carl Warden, of Bell Ingram’s Perth office said the impact of the tax regime has been marked in Perthshire and the surrounding area.

“We recently sold a property at £1.15m and the LBTT was £96,350, compared to stamp duty in the rest of the UK at only £58,750 – that’s a £37,600 difference,” he said.

“This transaction also attracted an additional 3% second home tax of £34,500, which was a grand total of an eye watering £130,850 in purchase taxes.

“Transactions attracting this level of tax are making people do one of two things; either not move at all, or negotiate hard on the asking price based on the vendor reducing their price by the level of tax due.”

Will Banham, of Bell Ingram’s Oban office, said the tax has also had unusual and unintended consequences for the west coast of Scotland.

“While LBTT has had a dampening effect on the country house market, the real impact on the west coast has come from the 3% premium for second homes,” he said.

“Following the Scottish government’s budget, there seems little doubt that the new LBTT regime is here to stay for now, but it will be interesting to see whether the government will review their policy if it is seen to be damaging the market.”