Soaring gas prices caused the demise of a raft of energy suppliers in 2021 and will likely lead to a “crisis” rise in household bills next year, industry experts have warned.

And while gas prices have declined after hitting record levels last week, there have been fresh warnings for Scots as experts predict continued volatility into 2022.

The unwelcome news that annual average energy bills could go as high as £2,240 comes as people across the UK are being hit by a cost-of-living crisis which has also seen the cost of food and other goods increase.

The concern has prompted Advice Direct Scotland to urge consumers to seek advice, particularly those who face the dilemma of choosing between eating or heating.

The free service provider added there will soon be details of “support available for those in financial difficulty” in the coming months ahead of consumer price increases due in April.

Business Secretary Kwasi Kwarteng held a meeting yesterday (Monday) with energy firms and the regulator Ofgem on how to deal with soaring gas and electricity prices.

The meeting came after Stephen Fitzpatrick, chief executive of energy provider Ovo, said the impact of soaring wholesale gas prices will be “an enormous crisis for 2022”, with it “almost certain” that energy bills will double from last year to £2,000 per household.

Government must act

Mr Fitzpatrick told BBC Radio 4’s Today programme: “Expecting consumers to shoulder that kind of volatility without any kind of support from Government is just unrealistic.

“It is a £25 billion hit to consumer spending next year and if this was any other kind of economic shock, we know that the Government would be stepping in.”

Those attending the meeting with Mr Kwarteng agreed on the need to “ensure UK customers are protected”, although details have not yet been confirmed.

A Government spokeswoman said: “Throughout the meeting there was discussion of the issues facing the sector and an agreement for meetings to continue over the coming days and weeks to ensure UK consumers are protected.”

Worries have been mounting since rising gas prices began bankrupting suppliers in September, but since then prices have risen from 54p per therm of gas to £4.50.

Since early September dozens of suppliers collapsed, with experts predicting further failures.

Price spike a ‘complete surprise’

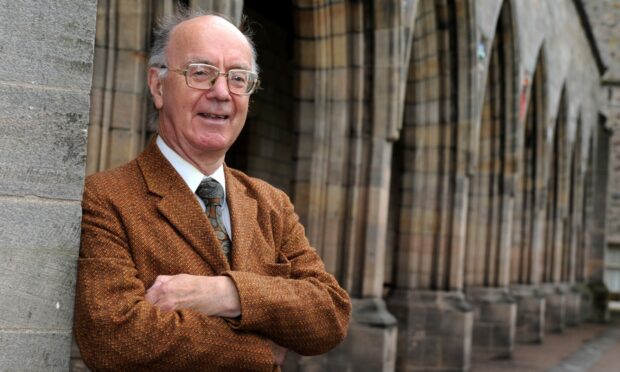

Alex Kemp, professor of petroleum economics at the University of Aberdeen, said the recent “spectacular increase” in the UK wholesale natural gas price “came as a complete surprise to everyone”, including market traders engaged daily in buying and selling the commodity.

The unprecedented spike was caused by something of a perfect storm on global markets.

These included a shortage of supply in 2019 followed by an increase in demand caused by unusually cold weather and a shift to lower carbon gas in the far East. Another issue facing markets was uncertainty cast over the future of a controversial Russian gas pipeline.

Mr Kemp added: “The near-term outlook is thus for continued volatility.”

The problem for businesses in the UK is they have been limited in what they can charge customers because of regulator Ofgem’s price cap.

The cap takes into account the price of energy, but does not change often enough to keep up with this year’s steep rises. The cap is moved twice a year.

So when gas prices went up energy suppliers were soon put in a difficult situation where it cost them more to buy gas than they were allowed to sell it for.

Flaws in the market exposed

The episode has exposed several flaws in how the market works, and will likely lead to permanent changes.

The crisis will likely change forever the way that the price cap is calculated.

Ofgem is consulting on a series of proposals which would mark the cap’s biggest overhaul since it was introduced in 2019.

Ofgem next changes the cap in April.

Predictions of where the price cap will be set have differed, but the most dire forecast came from investment bank Investec.

Its experts estimate that prices could go from £1,277 per year today for an average household, to £1,995, a rise of 56%.

Analysts at energy consultancy Cornwall Insight are slightly more positive about April’s cap, saying that it will reach £1,865.

But when the price cap changes again in October 2022 it could go as high as £2,240, according to the consultancy’s models.

Don’t panic

Andrew Bartlett, chief executive of Advice Direct Scotland, advised households: “don’t panic” despite the fact “it appears inevitable that steep increases are coming down the line”.

“These fresh warnings of looming price rises in 2022 will concern families across Scotland,” he said.

“We know that many Scots are already worried about paying their monthly bills, and many have been rationing their energy usage, so this will add to the anxiety.”

He urged worried consumers to seek advice by freephone 0808 196 8660 or on the energyadvice.scot platform, which the organisation runs on behalf of the Scottish Government.

Mr Bartlett said: “Energy bills and energy contracts can be a minefield for consumers, which is why we have made free and practical advice available to anyone in Scotland.

“Right now, the best advice is to remain on your current tariff and don’t panic about the collapse of energy firms because Ofgem will move customers to a new company with no loss of any money owed.

“There is also support available for those in financial difficulty and we will be making further information available to consumers in the months ahead.”

North Sea gas production could ease woes

Mr Kemp said the UK could act to stabilise the commodity price of gas by producing more oil and gas – an opinion which could prove unpopular among those who have campaigned against expanding North Sea operations such as Cambo.

However, he said the UK could follow the example of Norway, which combines “strong emission-reduction policies” with “continued exploitation of its gas reserves”.

He said: “Gas imports currently constitute over 50% of our demand. This is expected to continue.

“There are several substantial gas discoveries in the UK sector which should be economic at current prices even with strong environmental requirements and a substantial CO2 price.

“The result of their development would be increased economic activity, employment, and tax payments to the state.

“Norway is an example of a country with strong emission-reduction policies combined with continued exploitation of its gas reserves.”