Tayside Mountain Rescue could save up to £10,000 a year if a bid to make such teams exempt from paying VAT is successful.

Currently rescuers have to pay the 20% tax on the cost of everything from ropes to purpose-built vehicles, though they do receive a VAT exemption on medical supplies and life-saving drugs.

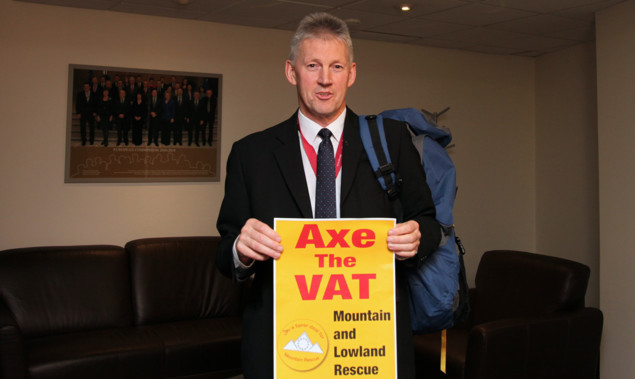

Liberal Democrat MEP Gordon Lyon, however, wants them to be fully exempt, in line with other emergency services.

He has already held talks with the EU tax commissioner, Algirdas emeta on the issue and is urging Scots to back the campaign as an EU consultation on public interest exemptions enters its final few days.

Stuart Johnston, leader of the Tayside Mountain Rescue Team, applauded Mr Lyon’s campaign.

He said: “The VAT exemption for mountain rescue has been an ongoing complication with the Government at Westminster for the past eight to 10 years.

“Government agencies who provide emergency services are VAT-exempt in the main but mountain rescue appear to be one of the few who are not, particularly on their equipment, which is the biggest cost we have on a yearly basis.

“We spend anywhere between £40,000 and £50,000 per annum to support the service in Tayside.

“About 8% of our income comes from the Scottish Government and the rest is from charity donations from the public,” he went on.

“We would save, on average, 20% of our overall yearly expenditure if we were VAT exempt.

“To us that would mean being able to provide much more training, particularly medical training, and be able to comfortably afford equipment such as ropes and medical supplies.

“I join other teams across Scotland in supporting George Lyon’s comment regarding VAT and it would be a marvellous boost to Scottish mountain rescue if exemption were to be applied.”

Mr Lyon pointed out that mountain and lowland rescue teams across the country were a valuable resource.

“In 2011 alone, a total of 573 incidentswere responded to by Scottish mountain rescue teams, and these numbers are increasing every year,” he said.

“Mountain and lowland rescue teams are effectively frontline emergency services in many parts of Scotland.

“These volunteers put their lives on the line and deserve our full support.

“The consultation in Brussels is closing soon and this is our last chance to make the case for a change to the rules at the EU,” he continued.

“It is important that we send a strong message that axing the VAT is the right thing to do.”

Jonathan Hart, chairman of the Mountain Rescue Committee of Scotland, added: “Mountain rescue in Scotland is carried out by world-class volunteers delivering a service free of charge to people in need of aid in the mountains of Scotland.

“We are not a political organisation and support any move toward reducing costs or increasing income for Scottish mountain rescue teams.”