Bad weather before and after Christmas contributed to a decline in crucial December sales on Scotland’s high streets, figures published today show.

Combined with an “extremely competitive market” for food and drink, the inclement conditions meant total sales last month were 1.1% lower than during the all-important Christmas period the previous year.

Like-for-like sales, which strip out factors such as new store openings, were down by an even-deeper 2.9%.

Scottish Retail Consortium director David Lonsdale said the December sales figures were a “small setback” for retailers which would “hopefully prove short-lived”.

His comments came after the latest SRC-KPMG Scottish Retail Sales Monitor showed that like-for-like food sales fell 3.2% last month, while the non-food sector dropped 2.6%.

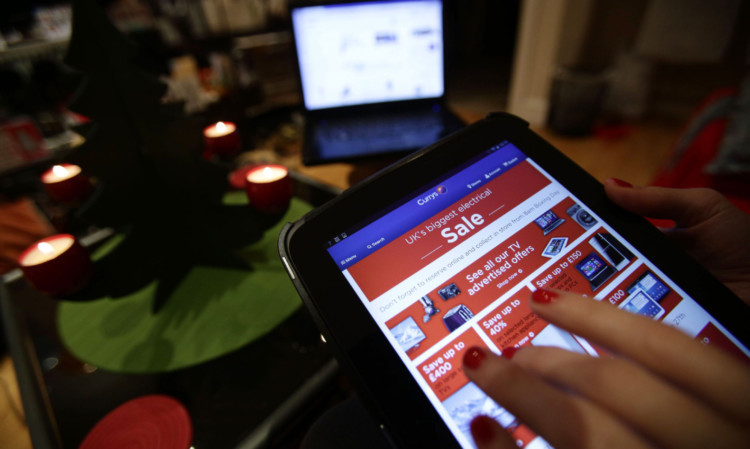

The figures come just after the SRC said the rise of online shopping had contributed to disappointing shopper numbers for Scotland’s high streets and out of town centres in December.

Today’s sales figures showed that Scotland performed less well than the UK as a whole, where total sales increased by 1.8% and like-for-like sales rose by 0.4%.

David McCorquodale, head of retail at KPMG, said: “On the face of it, the Scottish sales ended a year of recovery on a negative note.

“A combination of an extremely competitive market in the food and drink sector and gales in the few days before and after Christmas dampened an otherwise positive year.”

Scottish shoppers were cautious last month, with convenience stores doing better than big superstores and beer, party food and flowers being among the stronger sellers.

Clothing and footwear was said to be the best-performing category over Christmas, with many shoppers favouring practical gifts.

There was also good demand for electrical items, such as tablets, video game consoles, TV sets and cooking appliances. Sales in this sector were helped by heavy discounting.

“The overall trend for sales in 2013 was generally positive, however these figures show a small setback in December which will be disappointing news for Scottish stores but will hopefully prove short-lived,” Mr Lonsdale said.

“Clothing and footwear had a strong month. Scottish consumers have continued to update their wardrobes with new items, and retailers that have offered good ranges have benefited. There is also some evidence that convenience store formats have done well this month.

“However, in other categories, Scottish sales performance was weaker than in the rest of the UK. As our figures showed earlier this week, Scotland’s shops saw fewer people visiting them in December, which won’t have helped.

“The general fragility of the economic recovery, and evidence of an increase in online shopping, may also have had some part to play.”

Mr McCorquodale said: “The best-performing category was fashion and footwear but the evidence suggests this volume was driven by significant discounting, so retailers will be counting the cost in margin terms once they’ve added all the numbers up.

“Despite a stronger summer, these Christmas figures are a stark reminder that, while things may feel better in confidence terms, consumers spend cash and not confidence.

“Better days will only hit the high street when wage rate inflation takes off.”