Average advertised rents have hit a new high, but there are signs that the pace of the increases is slowing, according to a property website.

There are also signs that more landlords are having to reduce their asking rents, particularly for bigger homes, to meet what tenants can afford.

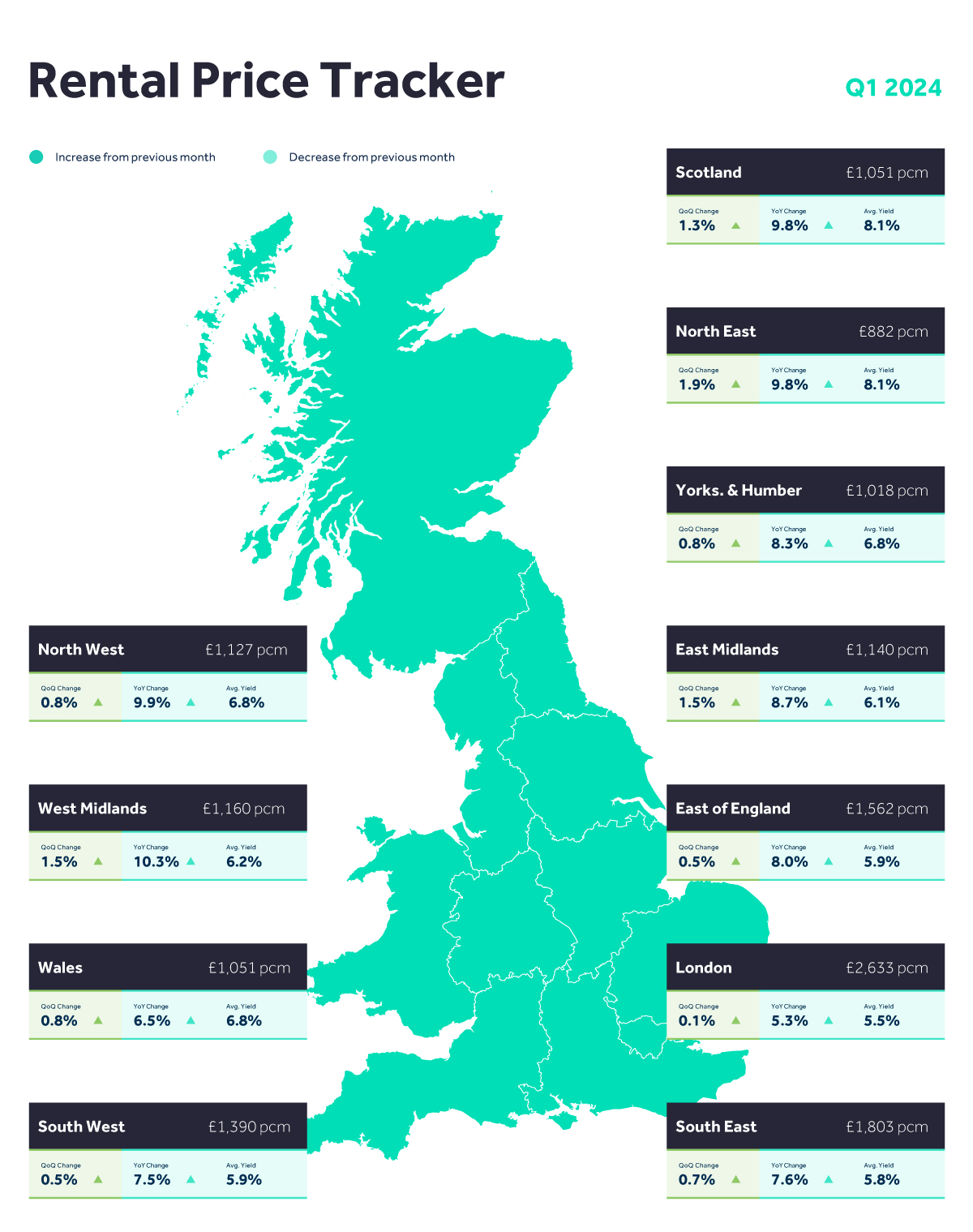

Across Britain, excluding London, the average monthly rent being asked for a property coming on the market in the first quarter of 2024 was £1,291, Rightmove found.

This was 8.5% higher than a year earlier, which was lower than the annual rise of 9.2% recorded in the fourth quarter of 2023.

The average advertised rent in London also hit a fresh high in the first quarter of 2024, but, at £2,633 per month, it was just £2 higher than the average asking rent in the fourth quarter of 2023.

London asking rents were 5.3% higher in the first quarter of 2024 than a year earlier, slowing from a 6.1% annual rise in the fourth quarter of 2023.

Although the balance of supply and demand is slowly improving from its peak, Rightmove estimates that nearly 50,000 rental properties would still be needed to head back to the pre-pandemic level of rental supply.

The number of available rental properties is 11% higher than last year, but 26% below 2019 levels, the website said.

It added that, while the number of tenants looking for a home to rent is lower than a year ago, it is still higher than in 2019.

Letting agents are fielding an average of 13 inquiries per rental property, Rightmove said.

While this is down from 19 at this time last year, it is still nearly triple the average of five in March 2019.

Rightmove also pointed to signs that tenant affordability is being tested, with reductions in rental prices at a five-year high for this time of year.

The proportion of rental properties with a reduction in price stands at 22%, up from 16% a year earlier, and the highest at this time of year since 2019, when the proportion was 23%, Rightmove said.

Asking rents for the biggest homes, including four-bedroom detached houses and properties with five bedrooms or more, are the most likely to be reduced, it added.

A third (30%) of top-of-the-ladder properties currently see a reduction in price, a new record for this time of year in Rightmove’s data going back to 2012.

Rightmove’s director of property science, Tim Bannister, said: “The rental market is no longer at peak boiling point but it remains at a very hot simmer.

“Looking at data across the whole market, we can see some slow improvements for tenants with more choice, and competition with other tenants slowly starting to ease. However, tenants may not feel the benefit of some of these improvements in their local market, as the balance between supply and demand remains so far from pre-pandemic levels.

“The fact that, even with some improvements to the level of supply, we are still nearly 50,000 properties behind the pre-pandemic market, is a stark reminder that the industry needs more good quality rental homes.”

Simon Thompson, group lettings director at Miles & Barr in Kent, said: “I think it is fair to say that price growth has eased; however the pace of new supply coming on to the market is also starting to slow, probably due to a combination of the relatively low numbers of new landlords coming into the market, and a few landlords looking to sell.

“There has been an increased number of price reductions, but this is mainly happening at the top end of the market, with smaller homes still in high demand. It appears stock will get tighter as we move into the summer months and as such the number of reductions will likely decrease.”

Halifax reported on Monday that, in the home buyer market, prices for smaller homes such as flats have been increasing at a faster rate than bigger properties.

The bank said the first-time buyer market has been “resilient”, and as interest rates have stabilised and buyers adjust to the new economic reality of owning a home, one way for buyers to compensate for higher borrowing costs is to target smaller properties.