The Covid-19 pandemic has seen many make the switch from cash to card as we take increased hygiene precautions. But just how dirty is the money in your pocket?

With the coronavirus outbreak, we have all become more aware of the health risks associated with personal interactions, social life and general hygiene – from the common cold to more serious illnesses.

When you think about how many people have touched the money you walk around with, it’s no wonder coins and notes are a hotbed of infection.

But just how unclean is the money we carry in our purses, wallets and the bottom of our handbags – and what are the health risks associated with cash use?

Under the microscope

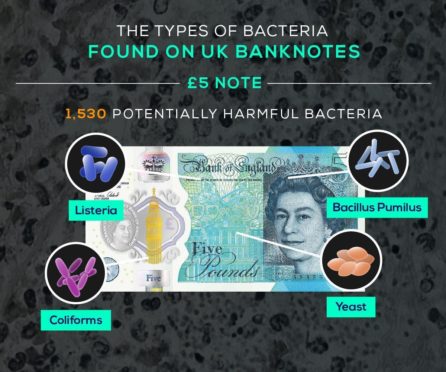

The £5 note is the dirtiest UK banknote with almost 153,000 bacteria accumulating on each one throughout its five-year average lifespan.

Bacteria gathered include coliforms, listeria and yeast, which can cause symptoms including diarrhoea, stomach cramps and vomiting.

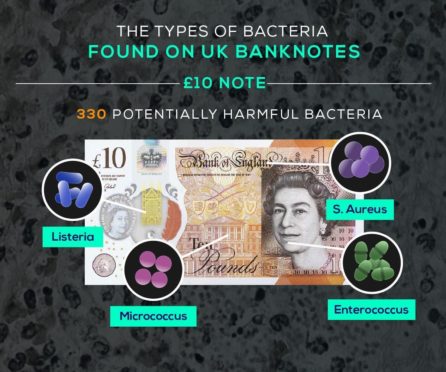

The average £10 banknote is spent around 10.5 times in the course of its five year lifespan.

It collects an average of 330 potentially harmful bacteria in the process, including listeria and staphylococcus aureus.

The latter is known to be antibiotic resistant and it is considered extremely dangerous by the World Health Organisation (WHO). It can cause skin infections and badly affect blood and intestinal organs.

Due to being used less frequently, the £50 note is the ‘cleanest’ UK banknote.

It gathers on average only 120 potentially harmful bacteria, including Bacillus Pumillus, Micrococcus and Staphylococcus Aureus.

Even so, bacillus pumilus is particularly dangerous for children and can cause skin infections.

Furthermore, micrococcus is a type of bacteria typically found in soil and water, and people with a weaker immune system are more likely to be affected by it.

How can I avoid getting ill from money?

The key ways to prevent illness through bacteria on money include regular hand washing, using hand sanitiser after coming into contact with money and wiping down banknotes.

GP Dr Giuseppe Aragona said: “It’s a well-known fact that money holds a whole host of germs.

“If you do not wash or hand sanitise your hands after touching cash or coins you could end up touching your mouth and transferring those germs.

“Germs on cash are likely to spread and infect much quicker because cash is exchanged constantly and these notes are not cleaned or sanitised.

“Ensure that you are bringing hand sanitiser when you go shopping or are out and about so you can ensure you sanitise after handling any cash.”

Cash or card?

Many have been concerned about transmitting the virus through money, and some businesses have even gone cash-free, accepting only card transactions to limit the potential risk to staff and customers.

As a consequence, the number of cash transactions in the UK decreased significantly over the past year and more than a third of shoppers have been stopped from paying with cash, in a collective effort to limit the spread of the virus.

However, even prior to the pandemic, cash use was on the decline, dropping by 22% in the past 10 years.

And if current trends continue, cash could be almost completely phased out as soon as 2026.