Rising energy costs, inflation and supply chain problems are causing worry for businesses in Scotland, a new survey has confirmed.

As the UK faces a cost of living crisis, one in five businesses expect to reduce operations this year due to the increase in energy prices, according to the Addleshaw Goddard Scottish Business Monitor report.

The survey, produced in partnership with the University of Strathclyde’s Fraser of Allander Institute (FoAI), examined business sentiment in the fourth quarter of 2021 and the outlook and expectations for the coming months.

Inflation worry

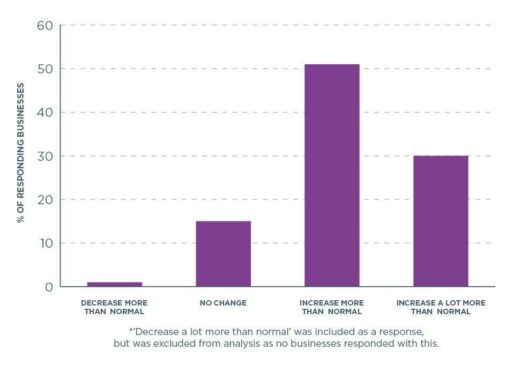

It found 80% of firms fear the price of their goods and services will increase more than normal in the year ahead as inflation reaches the highest level in decades.

Meanwhile Brexit is still causing difficulties as more than half of Scottish businesses report finding it difficult to source the goods and services they require.

Businesses are also largely failing to attract and retain workers they need – more than 80% admit they are struggling to recruit staff while almost a quarter of businesses also find it difficult or very difficult to retain their own people.

Nevertheless, businesses in all sectors reported positive net balances for the volume of business for the third consecutive quarter, and all core business indicators barring export activity remained optimistic throughout 2021, the report said.

Cost of greening

In the wake of COP26, the majority of businesses also remain committed to achieving net-zero.

However, the high costs associated with sustainable practices are a barrier to the transition according to 91% of respondents, with 84% also highlighting the need to prioritise Covid recovery and two-thirds identifying a lack of government funding.

Mairi Spowage, director of the FoAI, said: “These results show us that despite the reintroduction of some restrictions over the Christmas period, business optimism remained throughout the final quarter of 2021.

“However, inflationary pressures and rising energy prices are a concern for firms. Growing uncertainty throughout global supply chains is also causing problems for businesses across all sectors, particularly those in industries such as manufacturing.

“Difficulties for firms in hiring new staff also persist, with some firms expressing challenges in their ability to retain existing staff levels.

“However, it is positive to see the lasting effects that COP26 has had on business attitudes, with the majority continuing to signal their commitment to reaching their net-zero targets.”

Challenges ahead

David Kirchin, head of Scotland at Addleshaw Goddard, said: “As we gradually move away from the major restraints brought on by the pandemic, these latest results show that Scottish firms expect business volume to increase.

“However, they also see challenges ahead, whether linked to rising energy prices, supply chain challenges or the hiring and retention of people.

“We know from our clients and contacts across all sectors of the Scottish economy that many businesses are seeing opportunity within the drive to do things differently.

“The past two years have seen an acceleration in disruption and the practical innovation and imagination it breeds, with tech on the rise in all sectors and intellectual property becoming ever more important and in need of protection.

“One thing that is also clear from the results of the Business Monitor is that continuity of supply of goods and services is vital and the sustainability of supply chains, their resilience and flexibility, is key – to achieve this businesses will be well service to have a crystal clear picture of the commercial arrangements in place with their suppliers.

“Similarly, the ‘war on talent’ shows no sign of ending.

“Businesses continue to deal with inflationary pressures on salary costs while having to focus on making themselves places where people want to spend their working time.

“Employees are now weighing up work/life balance, diversity and inclusion, and environmental, social and governance issues.

“All employers are having to ask themselves just how they continue to build an inclusive and sustainable culture.”