How does it feel to have invested billions of pounds when global stock markets suddenly fall more than 20%?

One man who can answer this is Craig Baker, the global chief investment officer of Willis Towers Watson (WTW), which operates Dundee investment house Alliance Trust’s portfolio.

When the world was plunged into uncertainty as Covid-19 hit last spring there was the fastest stocks sell off in history.

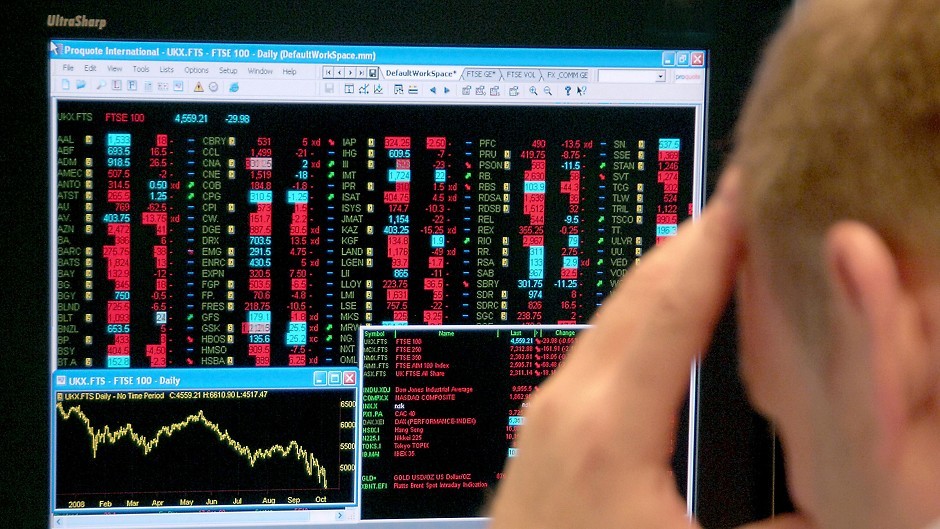

The Dow Jones in the United States dropped by 26% in just four days. The FTSE100 fell almost 30% in a month.

Surely a terrifying time to have billions invested in the stock market? Surprisingly not according to Mr Baker.

‘We didn’t panic’

“We were actually quite comfortable,” he said.

“We have a nice diversified portfolio and invest for the long-term so we didn’t panic.

“In March, April, May we looked closely at each company.

“We were happy with the quality of the businesses we had invested in and that they would survive.

“We think about the three to five year outlook rather than three to five months or three to five weeks. And we remain positive that over the long term we will significantly over-perform.”

Balanced strategy with several stockpickers

WTW was appointed to manage the Alliance Trust portfolio four years ago.

It oversees the strategy and performance of eight stock-picking firms who each have a slice of the FTSE250 firm’s portfolio.

In 2020 Alliance Trust provided a return to shareholders of 8.5% despite an extremely volatile market.

Mr Baker said he was disappointed it had underperformed the industry benchmark of 12.7%.

‘Extraordinary year’

He added: “It was an extraordinary year. The situation where almost half the return of the MSCI World Index came from just five companies is a strange one.

“Throw in the fact you also had the fastest sell off in markets in history followed by the fastest bounce back in history.

“Then there’s the fact that everyone has had to become epidemiologists to try to understand what’s going on.

“From a performance angle we had a tough 2020 underperforming the benchmark by about 3%.

“It’s disappointing to only be 1.5% ahead over the four year period (since appointed by Alliance Trust).

“2020 was tough but we are proud of how the portfolio has held up and more importantly excited about what it means for the portfolio from here.”

Next decade may not be ‘stellar’

Mr Baker said he was “relatively cautious” on the performance of stock markets over the coming decade.

In the short term there is the ongoing pandemic, rising unemployment and recessions.

In the medium term the process of rebuilding countries’ finances will take place, as seen by the Chancellor Rishi Sunak’s move to increase Corporation Tax to 25% in Wednesday’s budget.

Mr Baker added: “We don’t expect equity returns over five, seven or 10 years are necessarily going to be stellar but we don’t think the market is overvalued compared to bond rates.

“We are not trying to time the markets at all.

“There are pockets of the market that are expensive but as a whole we wouldn’t say massively because we look at it relative to what other asset classes you can invest in.”

Raising dividend payment for 54 years

Alliance Trust raised its dividend, for the 54th consecutive year, by 3% last year.

Mr Baker said he expected the increased dividends to continue.

“Ultimately the dividend is a board decision but it’s unlikely they will want to be the ones who end the 54-year streak,” he added.

“This is a trust with a lot of revenue reserves. We had £100m in reserves after the dividend payment in 2020.

“There was a motion at the AGM to move the merger reserve of another £645m to be a revenue reserve. So you could have around £750m in revenue reserves.

“We were £10m short on income on the portfolio to pay the dividend in 2020 – but we could do that for another 75 years.

“Dividend payments (from listed companies) are on the low end at the moment.

“That won’t always be the case and in theory the board could have even more flexibility on dividends over time.

“In comparison to most trusts, Alliance Trust has very healthy revenue reserves.”