A Fife woman who pled guilty to £20,000 VAT fraud before disappearing abroad for years has finally been sentenced, a decade after her crime.

Nicola Campbell made false VAT repayment claims to get money she was not due for the likes of personal mileage and groceries while she was director of a company called Business Support Scotland.

The offending took place at addresses in Dunfermline, Cupar or elsewhere between January 1 2010 and December 31 2014.

Dunfermline Sheriff Court heard Campbell pled guilty to the fraud in March 2018 but went to live in the Netherlands, before returning to the UK this year to answer a warrant.

Campbell admitted being knowingly concerned in the fraudulent evasion of VAT by repeatedly submitting false claims.

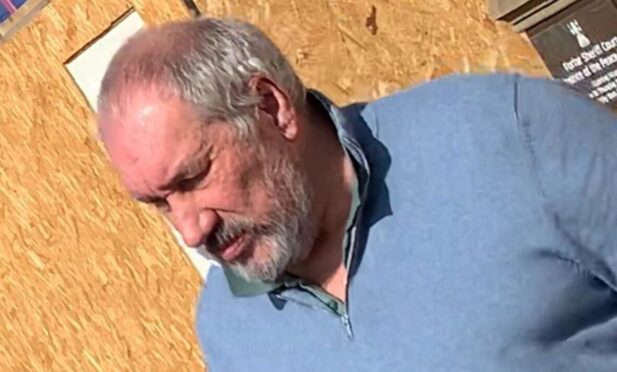

The 60-year-old, now of Crieff Road, Perth, appeared in the dock this week for sentencing.

HMRC ‘absconder’ claim

Sheriff Garry Sutherland gave her a five-month curfew order and 200 hours of unpaid work as a direct alternative to prison.

Following the sentencing, Lynsey Thompson, operational lead in the HMRC fraud investigation service, said: “Nicola Campbell left the country after pleading guilty to VAT fraud in 2018 – dodging sentencing for more than five years.

“This result underlines HMRC and our partners’ commitment to pursue absconders, regardless of how long they attempt to remain outside the UK.

“Campbell submitted false VAT repayment claims to receive money she wasn’t due.

“We encourage anyone with information about any type of tax fraud to report it on gov.uk.”

Accused said she ‘acted honestly’

Prosecutor Brogan Moffat told the court Campbell was director of Business Support Scotland along with her partner but became sole director of the company when he died in 2013.

Following HMRC investigations, Campbell was interviewed in August 2016.

The court heard when later charged with the offence, she responded: “I have struggled to accept the process.

“What you are saying to me, to be honest, I don’t fully process or digest that.

“I am just in shock, purely because how matters have been handled.

“How do I deal with this? Because from my point of view I have acted honestly and truthfully believing that the payments submitted were correct.”

Plea tendered in 2018

Defence lawyer Alan Davie said Campbell’s partner had set up the business but became unwell around 2011 and his client took over day-to-day financial administration.

The lawyer said VAT repayment claims were made on “things she knew were not related to business consultancy.”

Mr Davie continued: “Following the death of her partner she was clearly under some financial pressure and emotional pressure.

“To be frank, she managed to convince herself she did not do anything wrong.

“That’s clearly not the case”.

Mr Davie said Campbell’s social work report “minimises her involvement” but the lawyer said his client told him she now fully accepts her guilt.

The lawyer said Campbell, prior to this, worked in the Netherlands, returned there and hopes to do so in future to take up work again.

Mr Davie told the court the case has a “lengthy history” and the guilty plea was tendered in March 2018.

He said Campbell will repay the £20,000 she obtained fraudulently and confirmed his firm is in receipt of the funds.

In sentencing, Sheriff Sutherland told Campbell: “Completing the (unpaid work) hours and having liberty restricted will be tough.

“That’s quite right because of the crime you committed”.

For more local court content visit our page or join us on Facebook.